Calls and puts calculator

It also calculates and. The best online spreadsheet editor with excellent formula and editing.

Black Scholes Model Options Calculator Implied Volatility Premium Calculator Option Trading

Options profit calculator will calculate how much you make and the total ROI with your option positions.

. Select your option strategy type Short Call or Short Put Step 2. This calculator is created with Visual Paradigm Spreadsheet Editor. All fields are required except for the stock symbol.

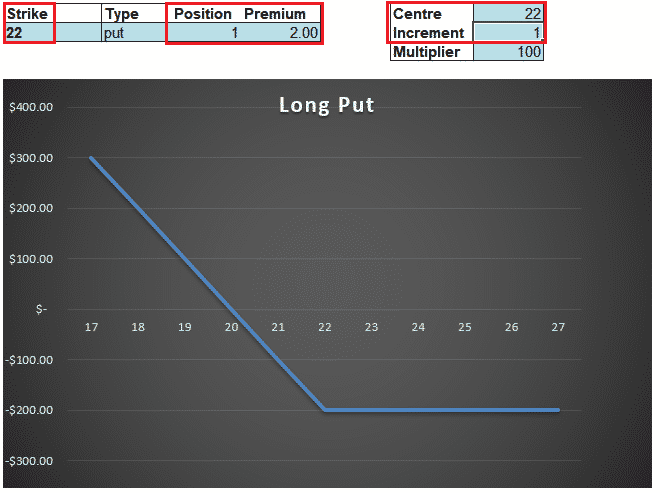

The long put calculator will show you whether or not your options are at the money in the money or. CallPut Spread Profit Calculator A call spread strategy consists in buying and selling a same quantity of calls but with a different strike price. Put Option Calculator is used to calculating the total profit or loss for your put options.

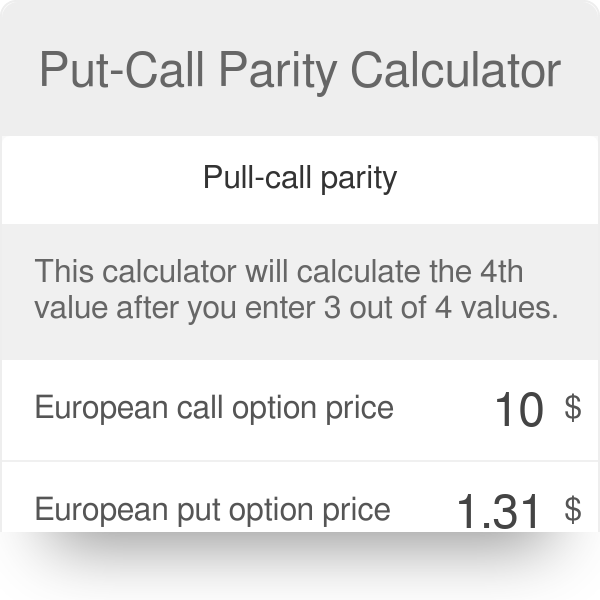

Select your option strategy type Long Call or Long Put Step 2. Theta is the amount the price of calls and puts will decrease for a one-day change in the time to expiration. In the put-call calculator by entering the information for the put option underlying asset and strike price you can easily calculate what the put option should be based.

A Call option represents the right but not the requirement to purchase a set number of shares of stock at a pre-determined strike price before the option reaches its expiration date. MIS gives you the auto square-off facility for open positions before market closes. Therefore at-the-money options are likely to have relatively significant rupee.

The long call calculator will show you whether or not your options are at the. Smartly designed order window and order book. Enter the underlying asset price and risk free rate.

Ad From Implied Volatility to Put-Call Ratios Get the Data You Need. The gain or loss is calculated at expiration. When purchasing a call option you are buying the right to purchase.

Invest in Direct Mutual Funds New Fund. Enter the maturity in days of the strategy ie. Enter the underlying asset price and risk free rate.

Calculate Fair Values of Call options and Put options for Nifty Options and a wide range of other Index and Stock options listed on the National Stock Exchange in India. You can use this Black-Scholes Calculator to determine the fair market value price of a European put or call option based on the Black-Scholes pricing model. Enter the maturity in days of the strategy ie.

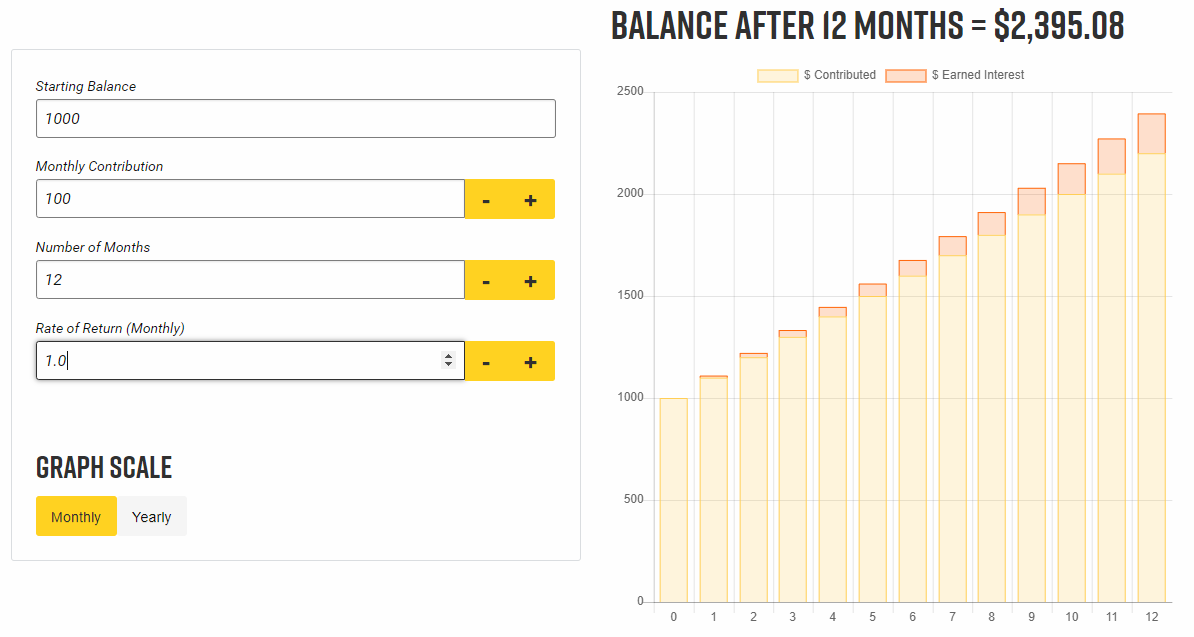

These calculations are all quite straight forward but if you want to visualize this in excel you can download the handy calculator below. Ad From Implied Volatility to Put-Call Ratios Get the Data You Need. This means that the OTM calls and hence ITM puts are trading with higher volatilities than normal against their at-the-money.

As a result both downside and upside are. Call Option Calculator Call Option Calculator is used to calculating the total profit or loss for your call options. This app calculates the gain or loss from buying a call stock option.

This is an online put call parity calculator. Excel Profit Calculator. Each option contract gives you.

Get the most from your trading by just paying a small margin.

Pin On Islamic Quotes

Call Option Calculator Put Option

Put Option Calculator Easy To Use Excel Tool

Put Call Parity Calculator Understanding Arbitrage

Long Call Calculator Options Profit Calculator

Options Spread Calculator

Stock Options How To Use Puts And Calls Budgeting Fundraising Book Community Board

How To Calculate The Perfect Call To Put Ratio Calculator Stock Market Ratio

Pin On Finance

Put Option Calculator Easy To Use Excel Tool

Options Profit Calculator Calculate Options Prices Greeks 2020

Compounding Gains Calculator Tackle Trading

Options Profit Calculator Options Calculator

Funny Old School Humor Calculator Notebook Ad Funny Notebook Schoolhumor School Humor Funny Calculator Humor

Option Premium Calculator Streamlined And Easy To Use

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

Learning Resources Pretend Play Calculator Cash Register Toy Cash Register Play Cash Register Cash Register